This article originally appeared on SmartAsset.

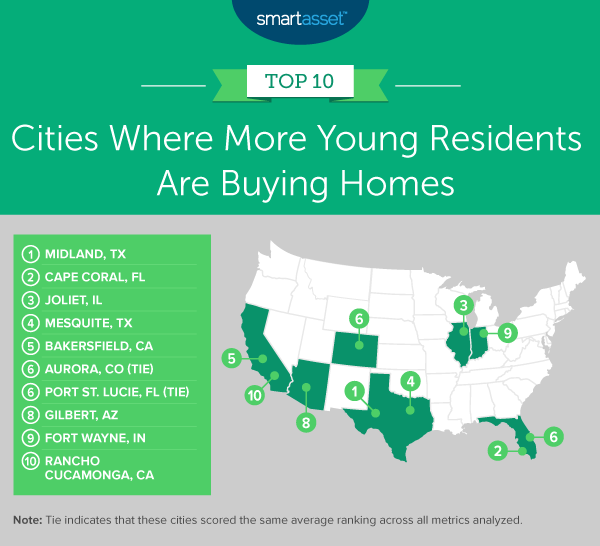

The homeownership rate in America peaked at a little more than 69% in 2004 before falling to 63.7% in 2016, according to U.S. Census data. Despite the fact that it has rebounded to a little more than 65% in 2019 overall, only 36.4% of Americans younger than 35 own their homes. It may be easier in some places, though, for this young cohort to buy homes. To that end, SmartAsset crunched the numbers to find the cities where people younger than the age of 35 are most likely to own their own home – and to see where this number has gone up in recent years.

To find the cities where more under-35 residents are buying homes, we compared the homeownership rate for this demographic in 2009 with the homeownership rate in 2019 for 200 of the largest U.S. cities. For details on our data sources and how we put all the information together to create our final rankings, check out the Data and Methodology section below.

Key Findings

- Young homeownership has decreased overall since 2009. While there are plenty of cities where homeownership among younger residents has increased, over the past decade the under-35 homeownership rate decreased by 3.71%, on average, across the 200 cities we analyzed.

- Under-35 homeownership lags compared to that of older generations, particularly in large cities. Though some two-thirds of all Americans owned their homes in 2019, just one-fourth (26.15%) of residents younger than 35 did in the 200 cities we analyzed. Homeownership rates are particularly low for the under-35 set in America’s largest cities: of the 10 with the highest populations, nine are in the bottom half of the study for 2019 homeownership rate (only Phoenix cracks the top half at No. 67), and all 10 had decreasing homeownership rates from 2009 to 2019, with six out of 10 — Phoenix, San Jose, Philadelphia, Dallas, Houston, Chicago — ranking in the bottom half of the study for change in homeownership rate from 2009 to 2019.

1. Midland, TX

Midland, Texas has seen a 10-year increase of 17.11 percentage points in the homeownership rate among people younger than 35, the largest growth seen in this study. The total homeownership for that age cohort in 2019 was 52.42%, the fourth-highest rate we analyzed for that metric. Together, this makes Midland the top place where more young residents are buying homes.

2. Cape Coral, FL

The homeownership for younger Cape Coral, Florida residents in 2019 was 55.54%, the third-highest rate in the study for this metric. That’s an increase of 8.71 percentage points compared to 2009, the fourth-highest increase for this metric across all 200 cities we considered.

3. Joliet, IL

Joliet, Illinois, located about 30 miles southwest of Chicago, had a homeownership rate of 63.48% for under-35 residents in 2019, the highest rate of all the cities we studied. Joliet ranks ninth for the 10-year change in homeownership, increasing 5.48 percentage points from its 2009 rate of 58.00%.

4. Mesquite, TX

Mesquite, Texas is part of the Dallas metro area, and in 2019, the homeownership rate among residents younger than 35 was 45.46%. That ranks 11th in our study, but in 2009 the rate was just 35.47%, meaning the increase over 10 years was 9.99 percentage points, third place for this metric.

5. Bakersfield, CA

Bakersfield, in central California, ranks 20th for homeownership rate among younger people in 2019, at 39.75%. That’s a 10.01 percentage point increase over the 10-year period from 2009 to 2019, the second-highest jump for this metric in the study.

6. Aurora, CO (tied)

Aurora, Colorado ranks 15th for the 2019 homeownership rate among people younger than 35, at 42.28%. That is an increase of 5.29 percentage points from 2009, the 10th-largest jump we observed in the study.

6. Port St. Lucie, FL (tied)

Port St. Lucie, Florida has the fifth-highest homeownership rate among younger people in 2019, at 51.93%. It ranks 20th for its increase in that percentage from 2009, at 2.70 percentage points.

8. Gilbert, AZ

Gilbert, Arizona, located near Phoenix, has the eighth-highest homeownership rate among residents younger than 35, at 50.08%. That increased 2.69 percentage points since 2009, good enough for 21st place in that metric.

9. Fort Wayne, IN

Fort Wayne, Indiana ranked 17th in both of the metrics we measured for this study. The homeownership rate among those younger than 35 was 41.24% in 2019, a 3.32 percentage point increase over the previous 10 years.

10. Rancho Cucamonga, CA

The final city in the top 10 of this study is Rancho Cucamonga, California, which ranked 21st for under-35 homeownership in 2019, at 39.39%. That is a 3.77 percentage point jump since 2009, the 14th-biggest increase we observed across all 200 cities in the study.

Data and Methodology

To find the cities where more young Americans are buying homes, SmartAsset examined data for 200 of the largest cities in the U.S. We considered two metrics:

- 2019 homeownership rate for those under 35. This is the homeownership rate among 18- to 34-year-olds. Data comes from the U.S. Census Bureau’s 2019 1-year American Community Survey.

- 10-year change in homeownership rate for those under 35. This compares the homeownership rate among 18- to 34-year-olds in 2009 and 2019. Data comes from the U.S. Census Bureau’s 2009 and 2019 1-year American Community Surveys.

First, we ranked each city in both metrics. Then we found each city’s average ranking and used the average to determine a final score. The city with the highest average ranking received a score of 100. The city with the lowest average ranking received a score of 0.

Tips for Buying a Home

- Never too old for some expert guidance. No matter what age you are, buying a home is a big step, and a financial advisor can help you get ready to take it. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Meticulous mortgage management. Chances are you’ll need a mortgage to facilitate buying your home. Use SmartAsset’s free mortgage calculator to see what your monthly payments might be based on your financing rate and down payment.

- Taxes don’t always have to be taxing. If you’re moving to one of the cities on this list, your tax burden might change. Use SmartAsset’s free income tax calculator to see what you’d owe the government each year if you pick up stakes and move.

Questions about our study? Contact press@smartasset.com.

Review the top 50 Cities Where More Young Residents Are Buying Homes.